Hidden Signals: The Layered Cake Approach to Unlocking Stock Market Insights in the REIT Public Market

By: Roni Appel, MBA, Assaf Zeevi, Ph.D

Introduction

In the intricate world of stock market analysis, a "layered cake model" has emerged as a powerful methodology. This approach involves dissecting signals useful for predicting stock returns into distinct layers of value. In this article, we delve into the concept of quantitative modeling and explore the different layers of analysis that constitute this approach. We also examine the relative importance of these layers and how they contribute to stock market predictions.

Beyond Fundamental Analysis

The shift towards advanced modeling and the application of machine learning technologies marks a significant departure from conventional analysis methods. These advanced techniques play a crucial role in uncovering signals that traditional methods might miss and are instrumental in dynamically adapting to evolving market scenarios and shifts. Grasping these changing market regimes is vital for detecting alterations in market behavior and tailoring our investment strategies to match these changes.

While fundamental analysis, focusing on essential financial metrics such as cash flow, dividends, growth, and profitability, remains a cornerstone of analyzing stock returns, it predominantly depends on information that is widely accessible through corporate filings (like 10-Q, 10-K, and 8-K forms), executive discussions, and company forecasts. This level of analysis, which draws on data readily available to all market players and extensively scrutinized by both the financial sector and media, is essential to stay abreast of market developments and avoid missing critical information. However, as a standalone, it is unlikely to offer a lasting edge over other market participants, as evidenced by the benchmark-like performance of many leading funds and financial instruments. But insights and analysis that build on this foundational layer have the potential to truly differentiate and add value.

Understanding the Layered Cake Approach

The essence of the Layered Cake Model (LCM) lies in breaking down the signals that forecast stock returns into several distinct strata. Rooted in quantitative modeling, this strategy aims to decode the complexities involved in predicting stock market movements using a stratified analytical approach. By delving into each layer, the method systematically uncovers and extracts additional signals from data previously dismissed as mere noise, akin to repeated and nested residual analysis in traditional regression. This process reveals new, valuable insights at every level, enhancing the predictive capability of the analytical framework.

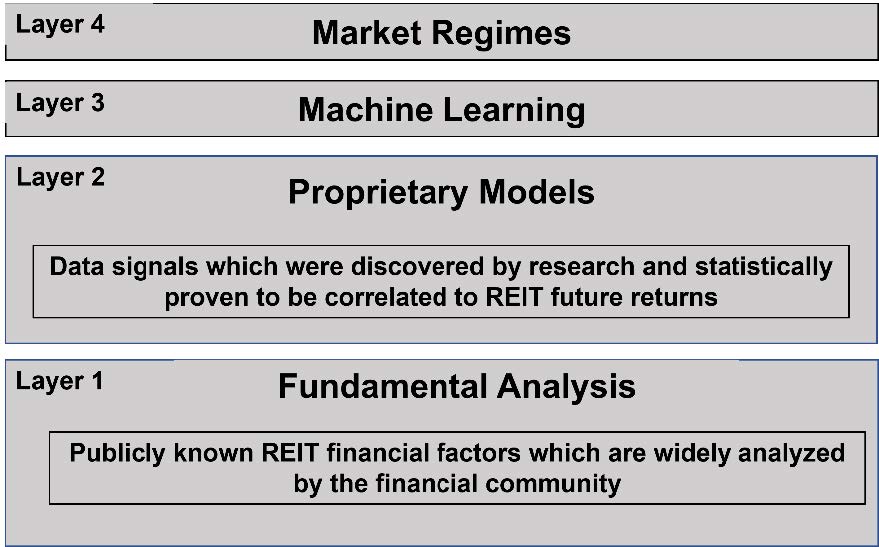

The Layers of Analysis at Arialgo

At Arialgo, the methodology is structured into distinct layers, each characterized by its specialized focus and analytical techniques.

It is important to note that while Layer 1 comprises analyses based on publicly available information and widely recognized financial factors—similar to those analyzed by most analysts in the REIT industry—the models and techniques employed in Layers 2 to 4 are proprietary. These proprietary layers are pivotal in generating unique insights that confer a competitive advantage in the market. In the subsequent sections of this article, we will delve into and elucidate the specifics of each analytical layer, highlighting the innovative approaches that set Arialgo apart.

Exhibit 1

Exhibit 1 illustrates the Layered Cake Model as implemented by Arialgo. In the subsequent sections of this article, we will delve into and elucidate the specifics of each analytical layer.

Layer 1: Fundamental Analysis - This foundational layer delves into quantitative fundamental metrics such as cash flows, dividend growth and coverage ratios, profitability, and growth, among others. It serves as the bedrock for assessing a stock's intrinsic value, relying predominantly on information that is publicly accessible.

Layer 2: Advanced Factors and Statistical Models - Building on the foundation laid by fundamental analysis, this layer integrates both straightforward as well as potent factors known for their predictive capabilities regarding future stock returns. It employs complex statistical models that tend to be underutilized within the broader finance community, often being proprietary and not widely recognized. A distinguishing feature of this layer is the necessity for a certain level of programming and automation to apply these models effectively across numerous stocks, highlighting its advanced and technical nature.

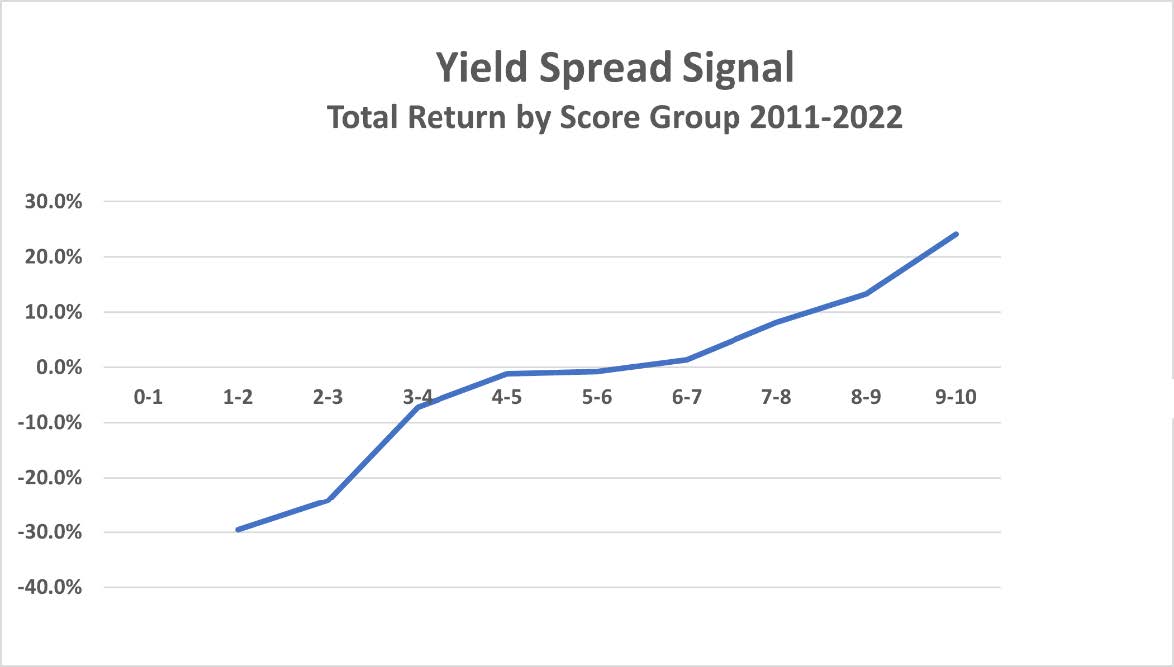

One example of such advanced models, of the type that constitute the 2nd analysis layer, is the Arialgo Yield Spread Signal which tracks the behavior of the yield spread between the dividend yield of a REIT security and the 10-year treasury interest rate. Such yield spread, in and of itself, is not useful for predictions of returns, but a more advanced and deeper statistical analysis of the spread reveals a correlation with future returns.

Exhibit 2

Exhibit 2 below shows the relationship between the indicator’s score and the 12-month subsequent total return of the security, based on a sample of 100 REITs over a period of 11 years (2012 – 2022). As can be seen, the higher indicator score groups generated higher total 12 month returns during this period.

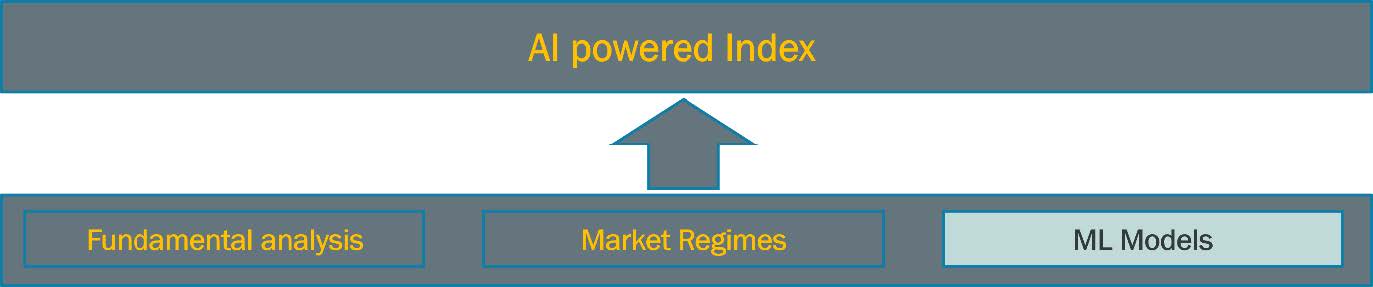

Layer 3: Machine Learning-Driven Analysis – This tier leverages advanced machine learning (ML) algorithms to identify complex, non-linear, and often occult dependencies across an extensive array of factors. Machine learning models, known for their varying levels of complexity, are frequently regarded as opaque since tracing the logic behind their predictions can be challenging. Moreover, these models necessitate an enhanced degree of automation for their effective and adaptive incorporation into investment strategies and portfolio management practices. Importantly, the extent of dependency on these ML models within the system and their overall contribution to the analytical framework can be meticulously calibrated and governed.

Arialgo's approach to integrating machine learning (ML) into its investment management system represents a significant departure from conventional methodologies. Recognizing the common critique of ML models as "black boxes" due to their opacity and complexity, Arialgo has developed a sophisticated strategy that enhances transparency and control. Instead of allowing ML models to independently dictate investment decisions, Arialgo embeds these models within a broader analytical framework. This framework operates as a composite layer of various models, where ML modules are assigned a defined weight in the total scoring process. By doing so, Arialgo ensures that the ML component contributes valuable insights and predictions while avoiding the pitfalls of over-reliance on algorithms that might otherwise obscure the decision-making process. This innovative approach allows for the integration of ML's predictive power with the clarity and accountability of more traditional analytical methods, striking a balance between advanced technology and practical investment wisdom.

Exhibit 3

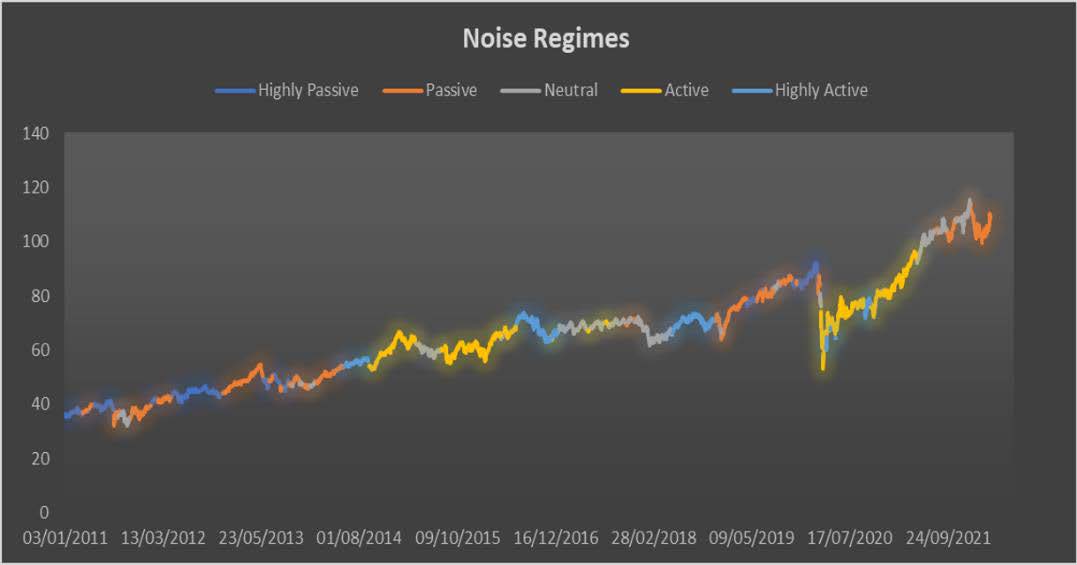

Layer 4: market regimes: are complex patterns that tend to shift over time with changing macro-economic environments, investor sentiment etc. When a regime changes, one or several basic behavior patterns of the market change. Such elements could be related to volatility, momentum, direction, trend, or even a factor not previously defined such as density or scatternets in a certain high dimension.

At Arialgo, the approach to navigating market regimes has been revolutionized through the introduction of a novel proprietary indicator that uniquely measures what it terms as the "market noise level," focusing on the market's density versus scatterness in a specific dimension. This cutting-edge methodology allows for a nuanced understanding of market conditions, particularly in the context of REIT stocks. By assessing the uniformity among these stocks, the indicator helps determine the extent to which individual investment opportunities are discernible. In scenarios where the market is dense, indicating high uniformity among REIT stocks, individual opportunities are less apparent, suggesting that a passive, index-like investment approach may be more appropriate. Conversely, in more scattered market conditions, where differentiation between stocks becomes clearer, an active trading regime is favored to capitalize on the distinct investment opportunities presented. This innovative strategy enables Arialgo to dynamically adjust its trading approach based on the underlying market structure, effectively transitioning between active and passive strategies in response to the insights provided by their proprietary market noise level indicator. This ensures that investment decisions are both data-driven and strategically aligned with current market dynamics, enhancing the potential for optimized returns.

Exhibit 3 below showcases the application of the market regime approach in relation to the MSCI 25/50 Real Estate Index over the period from 2011 to 2022. Each market regime is distinguished by a unique color, illustrating the shifts between varying degrees of active and passive investment strategies.

Exhibit 4

Conclusion

In our exploration, we have scrutinized the impact of each analytical layer in the LCM methodology on stock returns and portfolio optimization, underscoring the constraints of depending exclusively on fundamental analysis, which draws on widely accessible public data. We ventured into the realm of advanced modeling and machine learning techniques, which stand at the cutting edge of stock market analysis, offering a deeper, more nuanced understanding.

The LCM offers a holistic framework for investors, enabling a detailed dissection and comprehension of the complex dynamics driving stock returns. Adopting this strategy empowers investors to refine their investment tactics, make decisions grounded in a broader and deeper set of insights, unveil hidden trading signals, and achieve superior portfolio outcomes. This approach is adaptable across various analytical methodologies, promising to reveal fresh perspectives and opportunities within the stock market landscape.

By leveraging the Layered Cake Approach, we position ourselves at the forefront of financial analysis, ready to navigate the ever-evolving market with agility and informed confidence. This methodology not only enhances our current analytical capabilities but also sets the stage for discovering innovative investment opportunities, thereby reshaping our approach to market analysis and portfolio management.